| Whether a “C” corporation, an “S” corporation or a limited liability company (known as an “LLC”) is the best form of entity for your business will be based upon tax considerations, your intentions for financing and managing your business, as well as your long term goals for the later stages of your business. So, which one is right for you? Here, we break down these entity types and what they mean. |

The primary advantage to each of these entities is that they provide their owners with limited liability,so they are not personally liable for the debts or other obligations. Generally, corporations’ stockholders and LLCs’ members are only liable to the extent of their investments in those entities. (There are conditions that will give rise to exceptions to such limited liability known as “piercing the corporate veil” or the “alter ego” doctrine that permit a corporation’s or LLC’s creditors to hold stockholders or members personally liable[1], but such conditions do not occur frequently.)

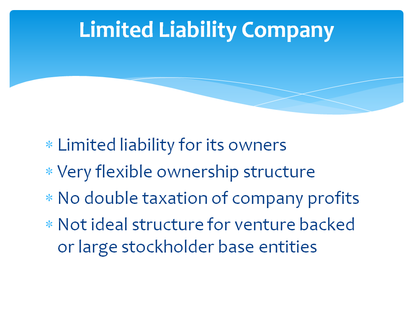

Limited Liability Company (LLC)

LLCs are often called “hybrid entities” because they operate much like partnerships and are taxed much like partnerships, but enjoy the same limited liability of corporations. A limited liability company does not pay taxes based on its income. Instead, an LLC’s profits and losses pass through the LLC in a tax-free manner to its members, who then pay taxes based on the allocation of the income they receive, or take the tax benefit of losses the LLC allocates to them. This differs from the “double taxation” that occurs when a C corporation distributes profits to its stockholders in the form of dividends. A C Corporation pays taxes based upon its income, then pays stockholders a distribution of the its after-tax income in the form of dividends.

LLCs are incredibly flexible entities in that they:

Limited Liability Company (LLC)

LLCs are often called “hybrid entities” because they operate much like partnerships and are taxed much like partnerships, but enjoy the same limited liability of corporations. A limited liability company does not pay taxes based on its income. Instead, an LLC’s profits and losses pass through the LLC in a tax-free manner to its members, who then pay taxes based on the allocation of the income they receive, or take the tax benefit of losses the LLC allocates to them. This differs from the “double taxation” that occurs when a C corporation distributes profits to its stockholders in the form of dividends. A C Corporation pays taxes based upon its income, then pays stockholders a distribution of the its after-tax income in the form of dividends.

LLCs are incredibly flexible entities in that they:

- can have any number of and many types of members, including corporations as members

- can have multiple classes of membership interests that provide for the distribution of profits and losses in any way agreed to by the parties, and do not have to be in accordance with a member’s percentage ownership

- can be managed directly by the members or by managers appointed by the members. However, for companies that intend to attract employees through equity incentives, an LLC may not be the correct choice. LLCs can have the equivalent of a stock option plan, but such a plan is cumbersome and may have unintended tax consequences. Also for companies that anticipate retaining as much of their earnings as possible for re-investment in the business or attracting venture capital financing or a large number of investors through other private financings or a public offering of stock, an LLC is not the most suitable choice. (Note that among other reasons venture capital investors do not generally invest in LLCs is that the allocation of profits and losses of an LLC may have undesirable tax consequences.)

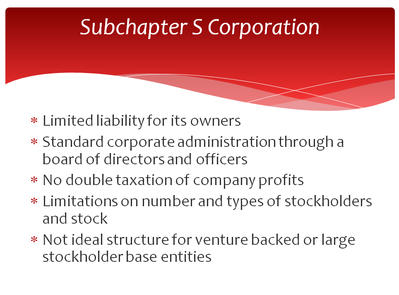

Subchapter S Corporation

From a corporate perspective there is no difference between and an “S” corporation and a “C” corporation, as both are corporations that have filed certificates of incorporation (or articles of incorporation, depending on the state law in the state in which they are organized), have stockholders as owners, and are managed under the direction of a board of directors. A corporation that qualifies may elect to be treated as an S corporation under the Internal Revenue Code, Chapter 1, Subchapter S, which permits the corporations to be taxed in much the same way that partnerships (and LLCs) are taxed. In other words, there is no double taxation of the corporation’s profits; the stockholders are taxed on their allocation of the profits, but the corporation is not also taxed on those profits. However, unlike an LLC’s flexible allocation of profits and losses, an S corporation’s stockholders always receive a pro rata share of the profits and losses in accordance with their ownership percentage of the corporation.

S corporations also have several restrictions on their ownership structure:

From a corporate perspective there is no difference between and an “S” corporation and a “C” corporation, as both are corporations that have filed certificates of incorporation (or articles of incorporation, depending on the state law in the state in which they are organized), have stockholders as owners, and are managed under the direction of a board of directors. A corporation that qualifies may elect to be treated as an S corporation under the Internal Revenue Code, Chapter 1, Subchapter S, which permits the corporations to be taxed in much the same way that partnerships (and LLCs) are taxed. In other words, there is no double taxation of the corporation’s profits; the stockholders are taxed on their allocation of the profits, but the corporation is not also taxed on those profits. However, unlike an LLC’s flexible allocation of profits and losses, an S corporation’s stockholders always receive a pro rata share of the profits and losses in accordance with their ownership percentage of the corporation.

S corporations also have several restrictions on their ownership structure:

- Stockholders may only be U.S. citizens, residents or natural persons (not an entity such as venture capital fund), although there are exceptions for certain trusts and certain tax-exempt organizations.

- There may not be more than 100 stockholders (although spouses and certain other family members may be deemed to be 1 stockholder.) An S corporation can have an equity incentive plan, but the total number of stockholders of the company cannot exceed 100 and such a plan will have certain additional restrictions regarding the transfer of such incentive equity.

- There can only be one class of stock.

- In addition to the above factors, the determination of whether an S corporation is appropriate for your business should be made in consultation with corporate and tax advisors. You will need to take into consideration not just the applicable corporate and individual tax rates, but also any plans you may have for selling your entity, as the structure of your company can have tax consequences to you and your other stockholders in a sale.

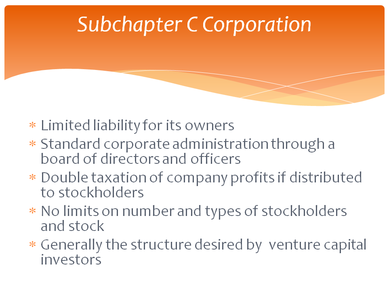

Subchapter C Corporation

Like both an LLC and an S corporation, a C corporation limits the liability of its owners to the amounts those owners have invested in the company. However unlike an S corporation, a C corporations has no limit to the type or number of stockholders it may have or to the type of stock that it may issue. Additionally, unlike an LLC or an S corporation, amounts distributed to a C corporation’s stockholders will be subject to double taxation. Note that if you intend to seek venture capital financing, have an unlimited amount of potential employees who may receive stock options, and desire to have your company issue shares in an initial public offering or be acquired by a large publicly traded company, the standard C corporation may likely be the best choice of entity for your start-up. However, there may be other tax considerations that could result in a different form of entity being the most suitable for you, so always discuss this choice with corporate and tax legal advisors.

Like both an LLC and an S corporation, a C corporation limits the liability of its owners to the amounts those owners have invested in the company. However unlike an S corporation, a C corporations has no limit to the type or number of stockholders it may have or to the type of stock that it may issue. Additionally, unlike an LLC or an S corporation, amounts distributed to a C corporation’s stockholders will be subject to double taxation. Note that if you intend to seek venture capital financing, have an unlimited amount of potential employees who may receive stock options, and desire to have your company issue shares in an initial public offering or be acquired by a large publicly traded company, the standard C corporation may likely be the best choice of entity for your start-up. However, there may be other tax considerations that could result in a different form of entity being the most suitable for you, so always discuss this choice with corporate and tax legal advisors.

[1] Piercing the corporate veil generally occurs when the formalities of a separate entity are not maintained or there is fraud or inadequate capitalization.

RSS Feed

RSS Feed