| Otherwise flourishing companies can get seriously derailed by dysfunctional or even just ineffectual Boards of Directors. Whom you choose to be on your start-up’s board of directors is at least as important as any hiring decision you will make for your young company. Read on to find out more about what a Board of Directors actually does, and what you should look for when choosing your all-star team. |

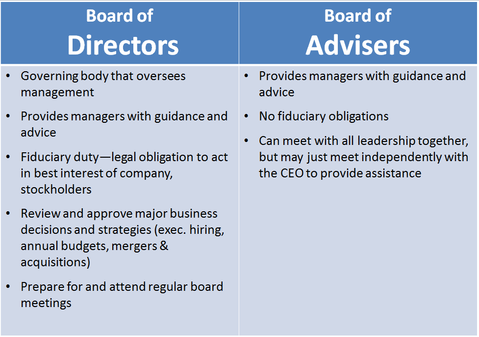

A board of directors has two primary roles:

(i) a governance body that oversees the management of a corporation, and

(ii) a provider of guidance and advice for the managers of the corporation.

Directors have fiduciary duties to the corporation and to the stockholders of the corporation that include the duty of care (the obligation to make decisions in a deliberate manner and to be informed of all material information reasonably available to them) and the duty of loyalty (the obligation to refrain from acting in a manner that would injure the corporation or stockholders, and, in particular, to avoid “self-dealing” or personal profit at the corporation’s expense.)

Boards of directors, and in some cases special committees of the board, typically review and approve (or choose not to approve):

- business strategies

- annual budgets and other business plans

- equity and certain debt financing

- executive hiring (including hiring and firing the company’s chief executive officer), executive compensation

- acquisitions by and of other companies and material joint ventures

Directors do not engage in the daily operation of the corporation, leaving those tasks to management. If the majority of your board meeting time is spent reviewing financial statements in detail, dissecting and suggesting improvements to the company’s technology, or reviewing and revising the terms of sale of the company’s products, then the Board of Directors is no longer acting as such and has, in effect, replaced the executive team’s management with its own.

How is that different from a board of advisers?

While every corporation has a board of directors, boards of advisers are optional and have no legal fiduciary role. Boards of advisers are typically composed of industry experts who assist management with specific projects, although may also offer strategic guidance. Additionally, unlike members of a board of directors who are expected to meet together regularly, members of a board of advisers may or may not meet with other members present, and usually provide individual assistance to the CEO. In further contrast to directors, advisers do not have decision making authority.

1. Relevant Experience – Each director should have deep knowledge of at least one of the following areas:

- the company’s industry - to understand the company’s challenges and to broaden management’s perspective

- related industries - to bring applicable insight that may not yet be prevalent in your industry

- the company’s customers – for contacts and to assist viewing the company and its products through the eyes of its desired customers OR

- experience successfully fostering early stage technology companies - to guide the company through the start-up and development phase into the early commercialization phases.

Try to include directors with complementary experience so that you can tap your board for strategic guidance, advice about penetrating your market, as well as counsel about weathering those inevitable rough patches.

2. Time – Each director must have time to:

- read company material in advance of board meetings – This will make your board meetings efficient and allow the board to focus on strategic matters and its governance role, rather than spending much of the meeting learning about the company’s progress since the last meeting. (Of course this means it is your responsibility to send the directors company information in sufficient time in advance of each meeting.)

- attend each board (and, if applicable, board committee) meeting in person – While there is no requirement that each director attend every meeting, having all board members present and focused at each meeting gives the company the full benefit of the directors’ expertise. Also, if your board members can’t seem to stop texting during board meetings, you may also want to consider scheduling in advance several breaks during your board meetings so that your directors can respond to their other duties without being distracted during the board meeting.

- contribute outside of board meetings – It is not unusual for companies in the early stages of their life-cycle to ask their board members for introductions, to attend certain important customer and investor meetings, or to interview candidates for executive positions.

If you have a valuable director candidate who cannot spend adequate time on a board of directors, but still wants to help the company and has valuable experience, consider asking that candidate to join a board of advisers instead.

- hear and respect their fellow directors and their fellow directors’ time,

- provide suggestions to fellow directors and management in a positive light, and

- explore potential issues early so there is less need to act abruptly.

Early stage companies that have several venture capital investors may have boards of directors dominated by representatives of those venture capital funds. Therefore, when you seek venture capital investment, make sure you include in your screening of investors whether the individual who is likely to have a board seat is a good fit given the criteria discussed above.

The right directors can supplement your expertise and guide your company to the next level of success. Spend time selecting your board wisely.

RSS Feed

RSS Feed